Time is running out for Super-Deducted air purification to future-proof your business operations

Under a Company’s Annual investment allowance you can deduct the value of an item that qualifies for Annual Investment Allowance (AIA) from your profits before tax1.

You can claim if you rent or own the building, but only the person who bought the item can claim.

One can claim back qualifying items normally from plant & machinery allowances (PMA) and with what are known as “integral features”:

Integral features – definition

Integral features – definition

The rules on integral features apply where a person carrying on a qualifying activity incurs expenditure on the provision or replacement of an integral feature for the purposes of that qualifying activity. Each of the following is an integral feature of a building or structure:

- an electrical system (including a lighting system).

- a cold-water system.

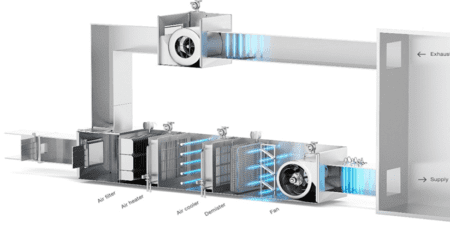

- a space or water heating system, a powered system of ventilation, air cooling or air purification, and any floor or ceiling comprised in such a system.

- a lift, an escalator, or a moving walkway.

- external solar shading.

Only assets that are on the list are integral features for PMA purposes; if an asset is not one of those included in the list, the integral features rules are not in point.

The rules also specifically clarify that the new definition does not extend to any asset whose principal purpose is to insulate or enclose the interior of a building, or to provide interior walls, floors or ceilings which are intended to remain permanently in place. So, if, for example, a business installs a new permanent false ceiling in its premises, to conceal new wiring and service pipes, expenditure on that ceiling would not qualify for PMAs.

On the other hand, if a business installs in its premises a plenum floor or plenum ceiling, the principal purpose of which is to function as an integral part of the heating or air conditioning system (for example, the plenum floor or plenum ceiling may form the fourth side of a duct or channel through which stale air is extracted and treated air is discharged), that expenditure would qualify for PMAs as part of an ‘integral feature’ of the building or structure.

Air purification or ventilation improvements to create infection resilience, comply with HSE guidance or other Regulations all, if hard-wired, can be claimed back under new Covid relief for businesses.

The AIA was temporarily increased from £200,000 to £1,000,000 from 1 January 2019 until 31 December 2021. There have been no further extensions announced since then, therefore businesses should plan for this to reduce back to £200,000 losing £800,000 of opportunity for investing in air purification, effectively for free once offset against tax.

Also, from 1 April 2021, companies can also claim a ‘super deduction’ which attracts a 130% deduction on allowable plant, machinery, and integral features, mentioned above. This is more generous than the AIA, which only gives a 100% deduction on up to £1,000,000 of expenditure.

Whereas, for expenditure that only qualifies as a ‘special rate’ item, such as integral features mentioned above, the super deduction only allows a 50% deduction. Therefore, the AIA would still be more beneficial in this case.

Furthermore, the super deduction only applies to expenditure which was not already committed to prior to 3 March 2021 (Budget Day), and it doesn’t apply to second-hand assets, or assets which are going to be leased out, whereas the AIA doesn’t have those same restrictions. Also, as mentioned above, the super deduction only applies to companies, not sole traders, or partnerships.

AIA is therefore still a generous and useful capital allowance, and businesses should carefully consider the timing of their expenditure and potentially accelerate expenditure on plant, machinery, and integral features to before 31 December 2021. Especially if they want to comply with the HSE’s Covid-Secure Ventilation standards but also, protect their people, operations, and business better, not just against this current airborne COVID virus but future proof their operations against whatever may come in the future whether a new variant, or other airborne pathogen hazards to create Pandemic Resilience.

Ref. 1. https://www.gov.uk/capital-allowances/annual-investment-allowance

Leave a Reply