Super tax deductions could fund the route to a lockdown-free future

A leading expert in infection mitigation believes that the introduction of tax breaks for investing in machinery provides an opportunity for businesses to guard themselves against the risks of future lockdowns.

Dr Rhys Thomas, NHS frontline doctor and chief scientific officer at PP-L, says that the announcement of a capital allowance of 130% on qualifying plant and machinery investments should encourage businesses to look at introducing systems that minimise the risk of airborne viruses like COVID-19, avoiding potential shutdowns in the case of future outbreaks.

Dr Thomas said: “When the Prime Minister announced the coronavirus recovery roadmap earlier this month, there was a clear shift away from the suggestion that widespread lockdowns would be used in the future, with the language instead leaning towards more localised measures if required.

“What this means on a business level is that the burden of infection risk management is being more heavily placed at their door, and therefore they should be looking at ways in which they can avoid outbreaks that cause shutdowns.

Currently businesses can only reduce their tax bill by a fraction of the money they have spent on investment, but the new measures – which will come into effect on April 7, 2021 – will allow for a 130% reduction, something which could stimulate more than £25 billion of economic growth during the two-year period the deduction applies for.

Dr Thomas said: “While the Prime Minister is calling the roadmap an ‘irreversible’ opening up of the country, we have to act with caution. You only have to look at the recent South African and Brazilian variants of COVID-19 to see that mutations can provide real stumbling blocks, and that’s without considering the potential for other future viruses that are transmitted in similar ways.

“If the roadmap is ‘irreversible’ and the threat of the virus remains high, a middle ground needs to be sought.”

While social distancing and travel restrictions have reduced transmission levels of COVID-19, the airborne risk of the virus has been largely underplayed, despite evidence that it is one of the primary methods of transmission.

Factoring that risk into future proofing will be crucial in businesses returning to work as normal and ensuring the highest level of COVID security, according to Dr Thomas.

“The levels of compliance with government guidelines around facemasks and human risk factors associated with overcrowding and operations have been very encouraging, but the emphasis needs to be on engineering infection control measures to ensure that the risks are at a minimum.

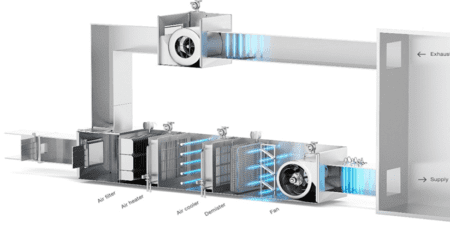

“Maximising ventilation to 10 air changes per hour is effective to a level, as is more natural air, better distribution and filtration. However, germicidal ultraviolet light (UVGI) is the most potent method of infection control with decades of proven effectiveness against all bacteria and viruses, including all currently discovered strains of the current coronavirus.”

UVGI systems have been widely used in hospitals, food production, laboratories and medicine manufacturing industries for many decades, with specifications adjusted to deal with the most prevalent microbial hazards in each environment.

They are also classified as integral features under HMRC definitions for the tax deduction, meaning that they are eligible for the 130% capital allowance.

Guidance around the use of ventilation and germicidal ultraviolet filters has now been included in the Health and Safety Executive’s latest update on COVID-secure Workplaces – Ventilation and the new global Well Buildings Standard – Health & Safety.

Paul Waldeck, managing director of PP-L, says: “Lockdowns and shutdowns have been the biggest enemy of business and the economy in this pandemic, so you can see why measures are being taken to stimulate industry. Business owners are worried about investing in plant and machinery because, in manufacturing for example, a COVID-19 incident can force a wholesale shutdown of a business for a fortnight, even if they’ve following all government guidance.

“COVID-19 has meant that we need to change our outlook and approach to make businesses more robust. It makes perfect business sense to improve facilities to make them properly bio-secure to safeguard the business operations first, before considering other investments in plant and machinery.

“Engineering interventions to infection mitigation are often relatively low cost, easy to retrofit, can run 24/7 safely above the workforce and yet, the benefits are enormous.”

Leave a Reply